The supply chain is experiencing the bullwhip effect brought about by the COVID-19 economy

28 June 2022

Freightwaves, a website for freight information and data analysis, said:The supply chain is experiencing the bullwhip effect brought about by the COVID-19 economy, and has established a large number of inventories. The slowdown in consumer spending caused by inflation and potential economic recession will have a huge impact on freight demand and prolong the period of inventory decline.Inflation, rising interest rates and economic uncertainty are weakening consumer confidence. For the supply chain, the fall in consumer demand comes at a bad time. The bullwhip effect makes a large number of inventories overstock, and the global supply chain is seriously damaged.

"Bullwhip effect" is a supply chain term, which means that the temporary surge in retail demand is amplified by upstream manufacturers and suppliers, whose rapidly increasing output far exceeds the level that consumers can support. Finally, retailers found that their inventory exceeded their sales capacity, and the initial shortage of goods eventually turned into a surplus of goods.

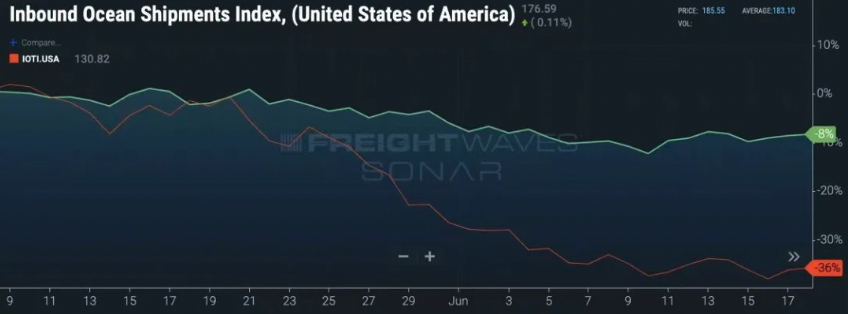

The following chart shows the bullwhip effect of the supply chain:

This chart shows the index of imported goods based on the number of bills of lading (blue) and the corresponding number of containers in TEU (green). These two indicators show how the ratio of containers to shipments evolved during the outbreak.

Before the emergence of the COVID-19, the container ratio of each batch of goods was quite stable, and the two indexes changed synchronously. From 2020, as large retailers add more containers to their scheduled shipments, the ratio of containers to shipments has exploded.

This situation will continue until the fourth quarter of 2021, when large retailers return to the previous ratio. Maybe they think they have enough inventory on hand to meet the demand. At that time, if consumer demand remains stable, the bullwhip effect will gradually disappear, because retailers will consume more inventory over time.

However, on February 24, 2022, the world changed, the conflict between Russia and Ukraine occurred, and the energy and food prices rose, causing high inflation.

As inflation continued to accelerate into the spring, consumers cut back on spending. Retailers found that their inventory level was higher than previously predicted, and explained this situation in the performance report.

After the results of the first quarter of 2022 and the subsequent announcement of excess inventory and weakening consumer confidence, large retailers reduced the number of containers per shipment.

77% of total US container imports come from industries reporting excess inventory (retail, electronics, furniture, clothing and home appliances), and freightwaves expects continued weakness until inventory returns to normal levels.

Wal Mart was the first large retailer to report excess inventory, and Target was the second. The two large retailers are also the largest importers of container freight in the United States. In 2021, they imported nearly 1.7 million TEUs, accounting for nearly 7% of the total container imports of the United States.

Last week, Nikkei Asia reported that Samsung was facing the bullwhip effect of excessive inventory and asked upstream suppliers to halve production in July.

In 2021, Samsung was the seventh largest importer in the United States. According to Sonar Container Atlas, Samsung imported 79000 TEUs last month.

According to the data of sonar container atlas, on 20th May, the proportion of containers began to diverge again, and this time it fell below the normal level before the COVID-19. Since then, freight volume has decreased by 8% (green), while container bookings have decreased by 36% (Orange).

With the slowdown of container transportation in North American ports, the weakness of the container market will have a significant impact on truck transportation in July. There is also the competition for warehouse space. The existing inventory is not sold at the expected price, forcing enterprises to find a warehouse to store the newly arrived inventory.

Shippers have slowed down the speed of shipping containers out of the port, resulting in the extension of container stay time.

The spot freight rate of containers continued to decline. According to the Baltic Sea freight index data, the weekly spot freight rate of containers from China to the west coast of the United States has dropped from US $15764 on April 15 to US $9195 on June 17, down 41%. Freightwaves does not expect container freight rates to soar and will continue to decline.