Chinese factory gate prices (PPI) in March rose at their fastest annual pace in nearly three years!

21 April 2021The price of means of production rose by 2.0%, with an increase of 0.9 percentage point:

Among the 40 industries surveyed, 30 industries have price increases, with an increase of 75%, 6 industries have price decreases, and 4 industries have no price changes.

The price of oil and natural gas exploitation industry increased by 9.8%, the price of oil, coal and other fuel processing industry increased by 5.7%, and the price of chemical raw materials and chemical products manufacturing industry increased by 5.3%, with the increase of 2.3%, 0.8% and 3.2 percentage points respectively.

The price of ferrous metal smelting and calendering industry increased by 4.7%, with an increase of 2.4 percentage points.

The price of domestic nonferrous metal smelting and calendering industry increased by 4.5%, with an increase of 3.0 percentage points.

It is estimated that the above five industries together affect the PPI rise by about 1.27 percentage points, accounting for 80% of the total increase.

The price of means of production rose by 5.8%, and the increase was expanded by 3.5 percentage points:

Ferrous metal smelting and calendering industry increased by 21.5% and expanded by 7.4 percentage points.

Nonferrous metal smelting and calendering industry increased by 21.3% and expanded by 9.2 percentage points.

Chemical raw materials and chemical products manufacturing industry, up 11.4%, expanded by 7.4 percentage points.

Oil and gas production rose 23.7%.

Oil, coal and other fuel processing industries rose 13.9%.

Electrical machinery and equipment manufacturing, up 1.0%.

Official report of the National Bureau of Statistics:

http://www.stats.gov.cn/english/PressRelease/202104/t20210412_1816172.html

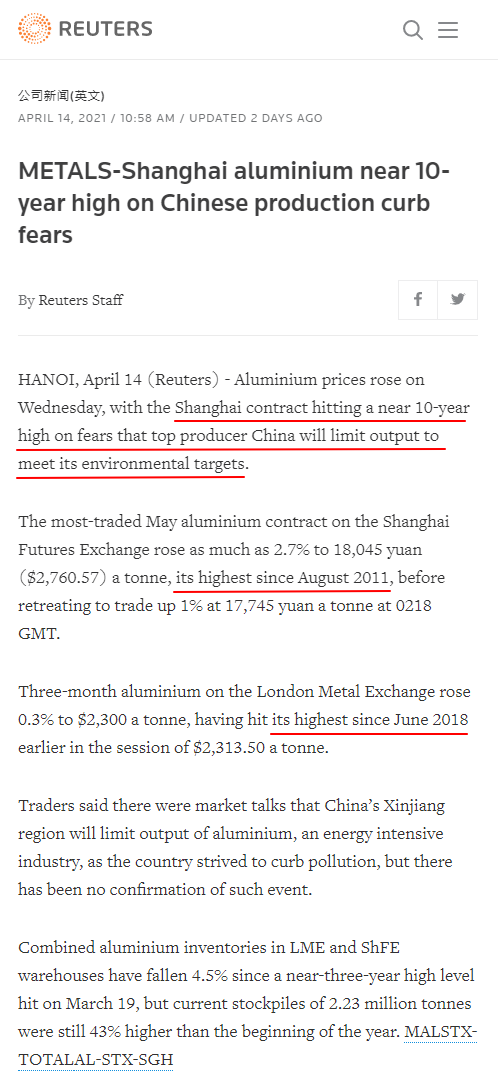

Aluminum prices jumped to their highest in nearly three years. The price for aluminum for three-month delivery on the London Metal Exchange has risen to its highest since June 2018, reaching $2,350 per ton. The most-traded May aluminum contract on the Shanghai Futures Exchange rose as much as 2.7% to 18,045 yuan ($2,760.53) a tonne, its highest since August 2011.

https://www.reuters.com/article/global-metals-idCNL1N2M705N

London Metal Exchange (LME) three-month copper hit a near 10-year high of $9,617 per tonne in late February. Goldman says copper is the new oil, raises price forecast to $11,000 per metric ton.

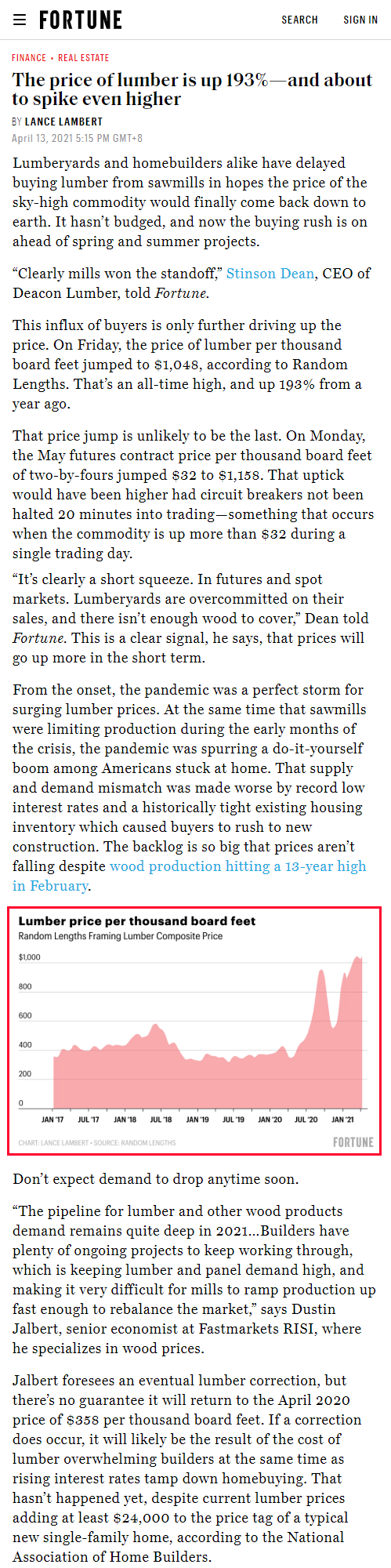

The pandemic was a perfect storm for surging lumber prices. According to Random Lengths, the price of lumber per thousand board feet jumped to $1,048 in April. That's an all-time high, and up 193% from a year ago.

https://fortune.com/2021/04/13/lumber-prices-2021-chart-price-of-lumber-futures-short-squeeze-home-sales-cost-april-2021-latest-update/